Monument Commercial Insurance Services, Inc. © 2006 - 2022

:: ANTI-SPAM :: COPYRIGHT NOTICE :: PRIVACY ::

:: TERMS OF USE :: LICENSED SERVICE STATES :: SUBMISSION NOTICE ::

Call 800.764.7507 To Get A Quote

" Better Rates, Better Coverage, Better Insurance"

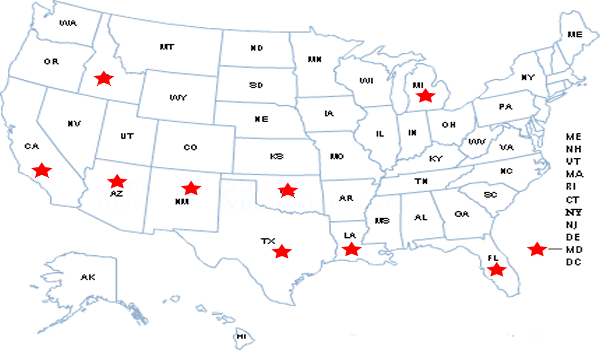

AZ INSURANCE LICENSE #: 973212

CA INSURANCE LICENSE #: 0F30735

FL INSURANCE LICENSE #: L077389

ID INSURANCE LICENSE #: 687310

LA INSURANCE LICENSE #: 519737

MD INSURANCE LICENSE #: 3000152708

MI INSURANCE LICENSE #: 0081085

NM INSURANCE LICENSE #: 100008955

OK INSURANCE LICENSE #: 3000903826

TX INSURANCE LICENSE #: 1760083

CONTACT US

PHONE: (800) 764-7507 - FAX: (661) 823-1102

EMAIL: info@mcisinc.com - COI REQUESTS: certificates@mcisinc.com

About Us

With Over 50 Years Combined Experience Providing Commercial Lines and Personal Lines Insurance Policy Services In Multiple States, You Can Be Confident In Our Ability To Acquire The Coverage You Need at a Price You'll Love!

Professional, Knowledgeable, Friendly Staff Provides a Superior Level of Certificate, Claims and Policy Service to a Broad Range of Clients in Multiple States.

REQUEST A QUOTE

Multi-State Insurance Services

Resources